500+ reviews ★★ ★ ★ ★ (4.9 of 5)

Need to file financial statement in XBRL format with SSM MBRS ?

Whether you are a company or an accounting firm we assist you in converting financial statements, annual returns and key financial indicators into XBRL format for MBRS filing with SSM.

- About

Why Businesses in Malaysia Trust Us

We make financial statement conversion and filing simple, quick, and accurate, so you can focus on your business while we handle compliance.

- No hidden charges

- Assured SSM MBRS Filing

- Security and compliance

- Transparent Pricing

- Quick Turnaround (2-3 business days)

- Our Services

What We Do Best

XBRL tagging and MBRS filing of annual returns and financial statements

XBRL Conversion of FS

We convert your financial statements and reports to XBRL format as mandated by SSM.

Filing with MBRS

We are MBRS registered Lodger to prepare and file the XBRL of AR, FS and EA on your behalf.

- Why XBerra

Why Companies Switch to Us

Agencies charge high fees and take weeks. With XBerra Tagger, you get MBRS-ready XBRL conversion in 2-3 business days at a fraction of the cost.

Save your time & money

With XBerra Tagger, you get your financial statements converted and filed with MBRS in just 2-3 business days at a fraction of the usual cost.

How we approach the common compliance issues?

Common Compliance Frustrations

- Financial statements stuck in Word/Excel, not SSM MBRS-ready

- Paying high agency fees with no transparency

- Weeks of waiting for simple conversions

- Risk of rejection at SSM MBRS portal

- Wasted time in endless back-and-forth

How We Solve Them

- Direct conversion to SSM MBRS-compliant XBRL

- Affordable, fixed pricing

- 2–3 business day turnaround

- Guaranteed successful filing

- Simple, guided process with expert support

Reliable Support When You Need It

Filing issues don’t wait and neither do we. Our support team is here to respond quickly, guide you step-by-step, and ensure your submission goes through smoothly

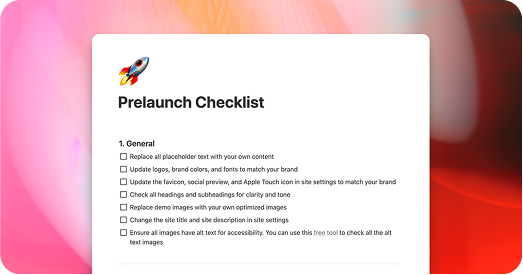

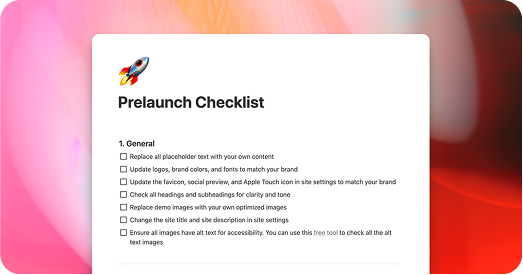

- Our Process

Convert financial statements into XBRL and file with MBRS in 4 easy steps

- 01

SIGN IN

Create your account online and add entities information

- 02

Place order & upload

Upload financial statements in Excel, Word, or PDF format.

- 03

DOWNLOAD XBRL

Receive the XBRL package as scheduled. Review and approve.

- 04

Submit XBRL to MBRS

If you need, we can also lodge XBRL with MBRS on your behalf.

- Testimonials

Loved by companies

See what compliance leaders at Fortune 500 companies say about our platform

I used your service for a few of our entities now and have been very pleased with your work both in terms of speed and quality.

Company Secretary

A well respected Business Group

I used your service for a few of our entities now and have been very pleased with your work both in terms of speed and quality.

Company Secretary

A well respected Business Group

I used your service for a few of our entities now and have been very pleased with your work both in terms of speed and quality.

Company Secretary

A well respected Business Group

I used your service for a few of our entities now and have been very pleased with your work both in terms of speed and quality.

Company Secretary

A well respected Business Group

I used your service for a few of our entities now and have been very pleased with your work both in terms of speed and quality.

Company Secretary

A well respected Business Group

I used your service for a few of our entities now and have been very pleased with your work both in terms of speed and quality.

Company Secretary

A well respected Business Group

Compliance Insights

Stay ahead of regulatory changes with simple guides and expert tips on ACRA filing and XBRL conversion.

- August 27, 2025

Top 5 Mistakes in ACRA XBRL Filing — And How to Avoid Them

Most rejections happen for avoidable reasons. Here’s how XBerra helps ensure your filing goes through the first time.

- August 27, 2025

What Changed in ACRA’s XBRL Filing Requirements for 2025?

A quick guide to the latest updates so

your company stays compliant without stress.

- August 27, 2025

ACRA Filing: How Fast Can It Really Be Done?

Agencies take weeks. XBerra makes it possible in just 2–3 business days. Here’s how.

Blog

Stay ahead of regulatory changes with simple guides and expert tips on ACRA filing and XBRL conversion.

- Tips

Building a Culture of Compliance: Leadership Strategies

August 27, 2025

- Tips

Building a Culture of Compliance: Leadership Strategies

August 27, 2025

- FAQ

We're here for you

Stay ahead of regulatory changes with simple guides and expert tips on ACRA filing and XBRL conversion.

Just message us and we’ll get back to you in under 8 hours

You can send us your financial documents in MS Word, MS Excel and PDF formats. In case we have problem processing the received format (especially scanned pdfs) we may request you for an alternative format.

If the document is in a different format, please contact us to check if we can accommodate. We have instances of successfully converting non-standard formats generated from third party accounting software packages.

We expect the files have no embedded files, macros, or active-X controls. Content in non-text structures such as pictures or graphical shapes will not be tagged. It is recommended that the font size is 12pt.

We typically deliver your MBRS-ready XBRL reports within 3-5 business days from the time all required documents are received. However, if you need an expedited delivery due to filing deadlines or urgent requirements, we can prioritise your report accordingly. Faster turnaround options are available upon request, and additional charges may apply. Please refer to our pricing section for details.

As an XBRL services provider, we work closely with the Suruhanjaya Syarikat Malaysia (SSM) to ensure full compliance with the Malaysian Business Reporting System (MBRS) requirements. Our tagging software is regularly updated in line with SSM’s latest taxonomy and technical standards. Before delivering your final XBRL report, we perform a validation test using the MBRS Preparation Tool (mTool) to ensure it meets all submission requirements.

All client data is securely stored on Malaysia-based or approved international servers that meet SSM’s data protection standards. File exchanges are carried out through our encrypted client portal using secure transfer protocols. Our processes are ISO-certified and audited for data security. Only qualified XBRL professionals handle your statutory accounts, all bound by strict confidentiality agreements.

We can offer offline billing for more than 5 entities or if you are an accounting who will use our services multiple times a year. To set up payment mode through bank transfer, please contact us at customercare@fintags.co.uk

Not just best price or quality, we strive to deliver wow experiences for our customers. We have a no-questions-asked refund policy if you are not satisfied with any aspect of our services. All refund requests must be made by email and before filing with the regulator.

- Contact

Ready to Transform Your Accounting Operations?

Join hundreds of enterprises who trust XBerra Tagger for their regulatory compliance and reporting needs across six countries

Cancel at anytime

Singapore

Singapore Malaysia

Malaysia South Africa

South Africa